Inspiring Confidence in Your Local Future

Many REVITALIZATION readers told me they enjoyed Issue #3’s Featured Article on Calgary, which described how this Canadian city is revitalizing their present while repositioning the city for a revitalized future. They asked me for more insights into such strategies. With that in mind, here’s the section of my upcoming third book, RECONOMICS: The Path to Resilient Prosperity (November 2019), which addresses this subject.

There was a lot of economic damage. But the greater damage is to the future.

How many retailers will want to come to Baltimore?

How many conventions will stay away?

How many hotel rooms will stay empty?

– Anirban Basu, a Baltimore economist, on the riots following the 4/27/15 funeral of Freddie Gray

When residents have confidence in a better local future, fewer move away, and more of them work on improving their community. When outsiders have it, more will move there. When a relocating employer has it, they’re more likely to overlook a place’s weaknesses, trusting that it will get improve. When developers have it, they see the place as having secure investment opportunities.

In an earlier chapter, I mentioned New York Governor Andrew Cuomo’s 2012 “Buffalo Billion” program. The state is investing $1 billion over 10 years in revitalizing that long-beleaguered city’s economy. Here’s what the governor said in a February 5, 2015 Brookings interview, when asked how the program was doing: “To date, approximately $842.2 million of the Buffalo Billion has been announced, which is expected to generate a total investment of over $8 billion. Over 5 years, this is projected to add over $11.3 billion in direct and indirect value to the economy and almost 14,000 jobs. The secret of the Buffalo Billion, however, is that we actually haven’t yet spent a billion dollars to see this change. We have only moved approximately $174 million out the door, and put just over $408 million under contract. What that shows is that this isn’t just about an injection of capital. It is about our commitment to this region, which brought energy and excitement back to Buffalo, and an economic boom followed.”

That experience demonstrates the revitalizing power of inspiring confidence in the future. “Money, in the end, is confidence” says Avinash Persaud, chairman of Intelligence Capital Limited (London, UK). Thus, any evidence that a place’s future will be prosperous is a form of “currency”. With it, a place can “buy” residents, investors, and employers.

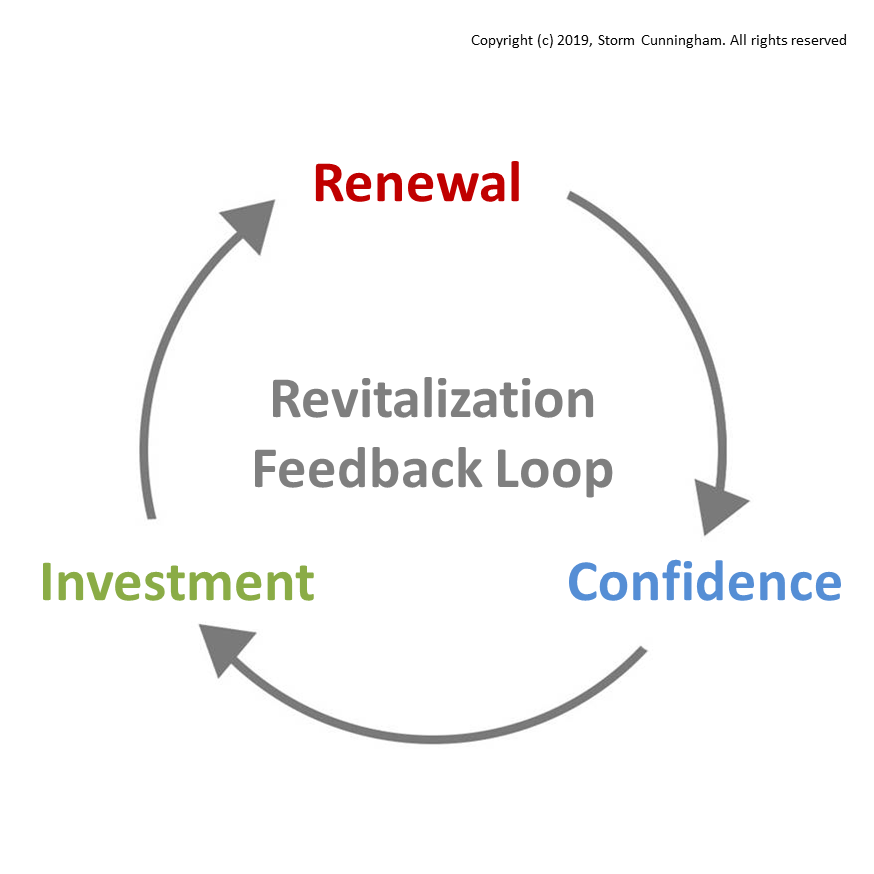

Confidence in the future creates revitalization, and revitalization creates confidence in the future. Lack of confidence in the future creates devitalization, and devitalization creates lack of confidence. This feedback loop can rapidly propel places upward or downward, so governments must start measuring confidence. Without that data, they’re flying blind, maybe into the wrong loop. As noted previously, governments mostly measure jobs, population, property values, and tax revenues, all of which fluctuate with transient internal or external factors. But none of these metrics reveal likely future prospects.

A simple initial survey of residents could establish a baseline local confidence factor. A similar survey could be done nationwide to measure outside perception. Repeating them annually would provide an early warning system for approaching economic “storms”. It could be as simple as one question asking citizens to rate their confidence in the local future on a scale of 1-10, or a single-word answer to “Do you feel this place is getting better or worse?” This would give leaders the opportunity to nip a negative shift in the bud with a confidence-building project or program, before a downward spiral gets out of control.

Measuring confidence could alert leaders to hidden devitalizing influences. There’s a lag between the time people start perceiving a place as being “on the way down”, and the time they start moving away or stop investing locally. As governments increasingly implement Adaptive Renewal and appoint Prosperity Directors, they’ll be better able to “print” this currency by tracking and measuring confidence. In fact, simply having a Prosperity Director comprises confidence-enhancing evidence.

Confidence in rising (or at least stable) value props up economies. When the U.S. severed its last ties to the gold standard in 1971, the dollar became an abstraction. It has zero value when shorn of confidence in its future value. Communities are like currency: investors don’t care if they’re soiled, torn, or faded, as long as they have confidence in their sustained worth.

Some cities and regions with an urgent need to increase confidence in their future aren’t presently distressed. Many are, in fact, presently wealthy. But some are overly-dependent on one industry, as Detroit was. Others are overly dependent on non-renewable natural resources, like oil and gas. Such fragile economies must take advantage of their current prosperity to make investments in a more-diversified economic foundation, and in more-efficient infrastructure.

We’ve discussed the essential role of quality of life in attracting new employers to an area. But even quality of life is insufficient if confidence in the future is shaky. For example: if a city is perceived as an oil and gas town, or a lumber town, or a mining town, a boom-and-bust economy will be assumed. The boom years attracts workers looking for jobs, but not employers or investors looking for a growing—or at least stable—economic climate. In good times, such places don’t need to fix their present, but they desperately need to fix their future.

How? It’s better to make people want to move to your city or nation, rather than relying on incentives. If their perception is that you’re a one-trick economy, they’ll not only worry about your stability: they’ll doubt that your place is an interesting place to live. Cities based on resource extraction usually build in a way that reflects their economic transience. They build as if they don’t intend to stick around. They create the bare necessities; eschewing major arts investments, failing to create inspiring public spaces or world-class higher education, etc. Fixing their future (strategic renewal) means rebuilding in a way that makes people rethink how they perceive the place.

Tactics and strategies have a nested relationship. As new, higher levels of strategy (larger scale or longer duration) are added, former strategies become tactics. It’s like matter and energy: the same thing viewed from different perspectives. The key is to have both: tactics that serve a strategy (as opposed to the reactive, opportunistic activities that pass for strategic efforts in most places).

There’s an interesting aspect to the relationship between strategic initiatives and confidence: sometimes, simply announcing them is all it takes to trigger revitalization. In Kansas City, Washington, DC, and many other cities, announcing future streetcars immediately triggered redevelopment along their routes. Revitalization started before the first transit shovel pierced the ground. Why? Because the announcement created new confidence in the future of the neighborhoods along the streetcar routes.

But this dynamic only occurs when government is credible. If it suffers from partisanship—each party blocking all initiatives of the other, regardless of merit and heedless of damage to public good—few will have confidence in its announced policies, programs, or projects. In that case, revitalization won’t precede the project. In fact, it will probably lag the project, with investors and redevelopers not trusting in its completion. That’s the cost of lack of confidence.

DC’s streetcar is poorly designed and implemented, so they might not enjoy such confidence in the future. In Arlington, Virginia (where I live) voters killed its poorly-planned streetcar due to loss of confidence in local government, but revitalization along its route had already started.

One profound impact of climate change is being ignored: its erosion not just of shorelines and polar icecaps, but of confidence in our local and global futures. Climate-related loss of confidence is a “hidden” economic calamity. A coastal city need not be hit by a record-breaking hurricane to feel the economic effects of climate change. Just the expectation of impending catastrophe is enough to destroy economies. As people become better educated about climate change, they’ll steadily lose confidence in the viability of coastal areas.

Few changes would be more economically devitalizing. Some 44% of the world’s population lives within 150km of an ocean. In 2010, 123,300,000 U.S. citizens (39%) lived in coastal counties. That’s expected to increase to 47% by 2020. Sea level rise, plus increased frequency and power of storms resulting from climate change, won’t only devastate local economies. Payouts from the misguided federal flood insurance program—which encourages people to live in harm’s way—plus the cost of federal disaster aid will likely break an already-tenuous federal budget.

It’s not just sea-level rise or storm damage: dying coral reefs (from ocean warming) and die-offs of other foundational species (from ocean acidification) are undermining commercial and recreational fishing economies. And it’s not just coastal areas whose “confidence factor” is vulnerable to climate change. Inland agricultural economies are being hugely disrupted as traditional crops no longer thrive there, and when hit by unusually-severe droughts. Paper and lumber-based economies are disrupted when pests and diseases rage out of control as a result of climate change (as we’ve seen with the pine bark beetle).

Those in industries not related to natural resources might feel protected. They’re not. What happens when everyone directly or indirectly dependent on farming, fishing, or timber (which is all of us) can no longer afford to buy a new iPhone? Or a new car? What happens to someone whose wealth is in real estate when investors lose confidence in the places in which those properties are located?

As noted earlier, most cities have multiple agencies and organizations renewing jobs, housing, infrastructure, brownfields, waterways, heritage, etc. But they are usually in dysfunctional isolation from each other. So too does the United Nations have many fragmented programs working to renew various aspects of our world, often in crisis-response mode. Maybe it’s time to recognize that regeneration is the essence of resilience and sustainability on a planetary level, not just the metropolitan level.

Stonington, Maine, a coastal community with a struggling economy and a commercially-important waterfront, has created a Working Waterfront Adaptation Committee. A pair of October 2014 articles in the local newspaper, The Ellsworth American, described the citizens’ efforts to prepare their waterfront—and thus their community—for the future. They might not be prosperous, but they see a clear and present danger to what prosperity they have. Here are a few relevant quotes from the articles:

- “facing multiple challenges…They include preparing docks and other facilities for more severe storms, changes in fisheries resources, and fewer job opportunities.”

- “higher sea levels will stress Stonington’s infrastructure…3-6 feet by the end of century.”

- “Gulf of Maine is warming faster than 99.85 percent of the world’s ocean; storms are likely to become both more frequent and more violent.”

- “Stonington rarely conveys the impression of a progressive community,” but [thanks to this Adaptive Renewal work] is now seen as being “on the cutting edge”.

Stonington’s focus is on protecting the future, not revitalizing it. But if other area communities don’t do likewise, Stonington could have the only working waterfront in the region, which would revitalize it. That “sole survivor” scenario isn’t a confidence-inspiring strategy, though.

Climate change is a global phenomenon with many local causes. Our global economy is an aggregation of local economies. What happens when investors’ diminishing confidence in local and national economies hits a tipping point, and they lose confidence in the global economy? If it makes sense for cities, states, and nations to have Adaptive Renewal systems, might it also be time for the UN to create a global system, facilitating and supporting national systems?

Ten years ago, few people had much confidence in the future of Los Angeles. Its downtown was dead, it was dependent on water piped from other states, and it was a transportation basket case. But in 2008, voters approved Measure R, raising $40 billion to re-do their transportation infrastructure. It will create 12 transit lines, 43 transit stations, and some 210,000 jobs.

Combined with their 50-mile restoration of the L.A. River, this investment is spawning downtown revitalization, plus widespread transit-oriented redevelopment projects that connect citizens to business opportunities, jobs, and housing. By renewing their future, the city that long epitomized sprawl is becoming a model of Resilient Prosperity.

About the Author

Storm Cunningham is the publisher of REVITALIZATION, a new twice-monthly global magazine (http://revitalization.org ).

Since 2002, he has been a full-time revitalization process planner for organizations, communities and regions. He’s also a professional speaker and workshop leader on community revitalization, economic resilience, and natural resource restoration. His clients include national and local governments, universities, and non-profits in over a dozen countries.

He lives in Arlington, Virginia, and is the author of two highly-acclaimed books:

The Restoration Economy (Berrett-Koehler, 2002), and Rewealth (McGraw-Hill Professional, 2008).

See http://RestorationEconomy.com and http://Rewealth.com for more information about these books.

His third book, RECONOMICS, will be published in November, 2019.

See http://StormCunningham.com for more on his work.

Storm can be reached at 1-202-684-6815, or at storm@revitalization.org