The Council of Development Finance Agencies (CDFA) is a national association dedicated to the advancement of development finance concerns and interests. CDFA comprises of the nation’s leading and most knowledgeable members of the development finance community representing hundreds of public, private and non-profit development entities.

Members are state, county and municipal development finance agencies and authorities that provide or otherwise support economic development financing programs as well as a variety of non-governmental and private organizations including bankers, underwriters, attorneys, financial advisors and other organizations interested in development finance.

Since January 2018, CDFA has worked closely with state and local agencies around the country to ensure the successful implementation of the Opportunity Zones incentive. CDFA has hosted both in-person events and online webinars for key decision-makers in an effort to foster a set of usable best practices that every state can adopt. In addition, CDFA has created an online Opportunity Zones Resource Center that houses information about each state’s Opportunity Zones along with recent headlines and information related to Opportunity Zones strategies and deployment.

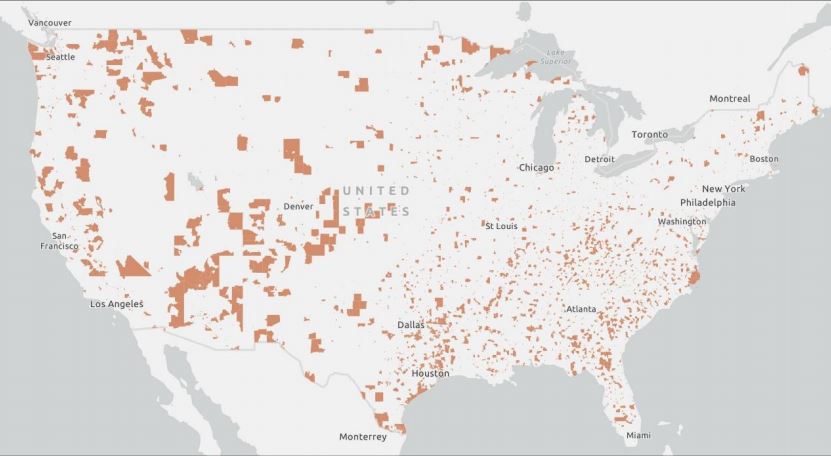

Opportunity Zones, created as a result of the passage of the Tax Cuts and Jobs Act, are low-income census tracts eligible to use tax incentives to encourage long-term investments in Opportunity Zones assets and property. Each governor could nominate up to 25% of their qualified low-income census tracts to become Opportunity Zones. This spring the United States Department of the Treasury officially designated more than 8,700 Opportunity Zones, located in every state and territory and the District of Columbia.

All designated Opportunity Zones are now eligible to receive investments from Qualified Opportunity Funds, which are investment vehicles that deploy capital into Opportunity Zones. Opportunity Funds are required to hold at least 90 percent of their assets in Opportunity Zones, and can invest equity into businesses or real estate projects located in Opportunity Zones.

These investments come with tax advantages to the investor. First, the capital gains invested in a Qualified Opportunity Fund are eligible for partial tax forgiveness if the investment is held in a Qualified Opportunity Fund for at least 5 years. After 5 years, only 90 percent of the original gain is taxed. If the investment is held for 7 years, only 85 percent of the original gain is taxed. Second, if an investment in a Qualified Opportunity Fund is held for 10 years, any tax on the appreciation of that investment is forgiven.

Map of designated Opportunity Zones courtesy of Economic Innovation Group (EIG).